Introduction

Accounts Payable (AP) departments receive invoices for a wide range of goods and services procured by various groups within their organizations. These invoices come from multiple sources and are in different formats. Each invoice must be coded in the company’s financial system and linked to its related purchase source, which could be a work order, purchase order, lease, contract, or project. Once this connection is established, the coded invoice is routed to the responsible party for approval. Upon approval, the invoice returns to the accounting department for payment. If discrepancies are found, the invoice is sent back to the provider for correction and resubmission. This traditional process is resource-intensive, time-consuming, and error-prone.

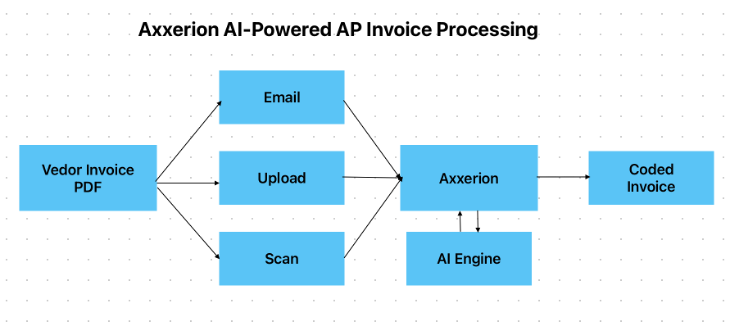

Introducing AI-Powered Automation

We have implemented an AI-driven automation process to streamline invoice coding and approval. Our system efficiently extracts relevant information from incoming invoices and automates the routing for approvals. The steps include invoice receipt and OCR (Optical Character Recognition), AI-based data extraction, and workflow automation for approvals and payments.

Invoice Receipt and Object Creation

Invoices are typically received via a dedicated email address. This inbox is monitored continuously. When a new email arrives, assuming it contains an invoice attachment, the system downloads the attachment and creates an invoice object. Emails that do not follow the expected format can automatically receive a reply explaining the requirements.

Each invoice object is assigned a unique tracking number and given the status of ‘auto-draft’, indicating that the invoice was automatically generated but has not yet been coded. The email’s attachment is downloaded and is attached to the invoice object.

AI-Powered Data Extraction

Traditionally, data extraction from invoices and entry into financial systems is a manual process. With AI, we automate this step.

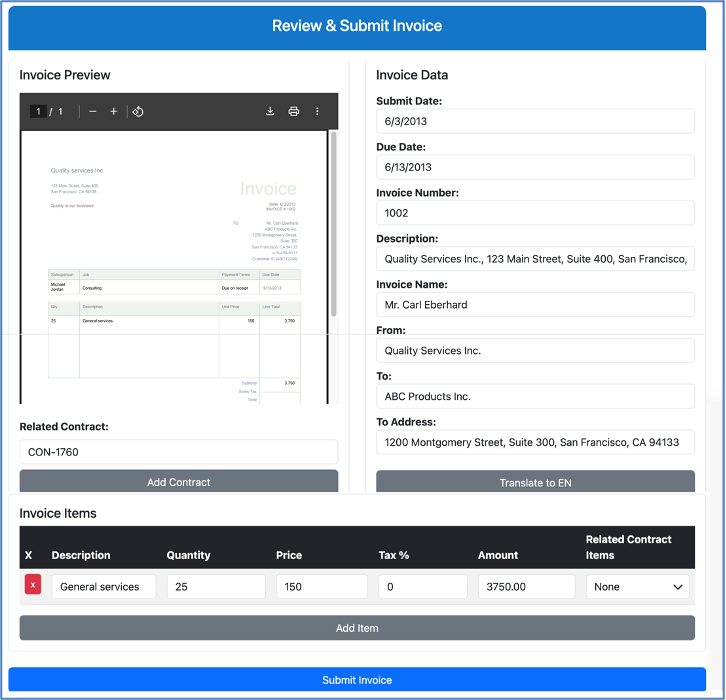

Invoices generally contain two main categories of information:

- Invoice Header: Includes general details such as the sender, invoice date, vendor invoice number, and associated purchase source ( related work order or purchase order, etc.)

- Invoice Line Items: Includes descriptions, quantities, unit prices, taxes, and total amounts.

Our AI engine analyzes the header information to identify and validate data. For instance, if a vendor name is recognized, the system checks for an existing vendor record. If it exists, it links it to the invoice; if not, it creates a new vendor entry.

Line items are also extracted and entered in the invoice object. In some cases, line items must match specific data from the purchase source, such as matching rent amounts in a lease. Others, like CAM (Common Area Maintenance) or electricity charges, may vary from month to month.

If a purchase source does not yet exist at the time of invoice receipt, the system can create the missing entries based on invoice details.

AP personnel can review and adjust any extracted data before the invoice moves to the next step.

Approval Workflow

Once invoice data is validated and linked to its purchase source, the system initiates the appropriate approval workflow. The invoice is sent to the designated reviewer. If any information is incorrect or incomplete, the reviewer can return the invoice for updates with a single click.

Flagging Invoices for Review

If the AI is uncertain about extracted data or cannot locate essential information, the invoice is flagged for review. These invoices are clearly marked, and the questionable fields are highlighted for manual verification before proceeding to approval.

Conclusion

AI-driven AP invoice processing, as outlined above, demonstrates how automation can significantly enhance efficiency and accuracy in day-to-day financial operations. A traditionally labor-intensive and error-prone workflow can now become streamlined, secure, and connected, ensuring faster turnaround times and greater accuracy.

Call to Action

For more information or a live demonstration of this capability, please feel free to contact us.